Other browsers such as Google Chrome, Internet Explorer, or Mozilla Firefox can help you isolate these kinds of issues. If you're to see the options and edit the reports, you can switch back to the main browser and clear the cache.

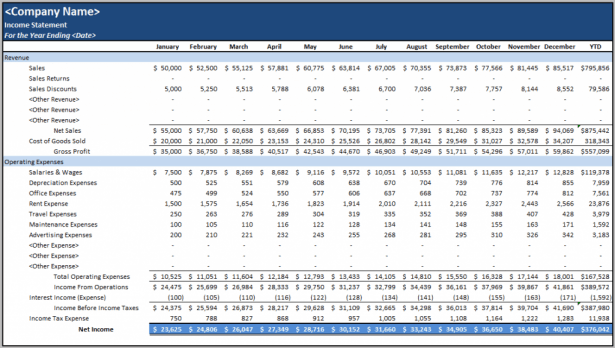

You have the option to add a column where you can select the percentage of Income. I looked into the screenshot you provided and you're currently using QuickBooks Online. The option provided by my colleagues is for QuickBooks Desktop. I'm here to ensure that you're able to customize your Profit and Loss report, ccetg. However, expenditure shares, or the percentage of a household’s budget spent on a particular component, can be used to compare spending patterns across areas. Export reports as Excel workbooks in QuickBooks Desktop.ĭrop me a comment below if you have any other questions. Spending differences may result from different consumer preferences or variations in demographic characteristics, such as household size, age, or income levels.Customize reports in QuickBooks Desktop.You can view it by clicking the Help option and selecting New Features.Īlso, I've attached some articles you can use to learn more about customizing reports, including exporting to Excel: For instance, if a person makes 1800 US Dollars (USD) per month, and spends 450 per month on groceries, the percentage of income would be (450/1800) x 100, or 25.

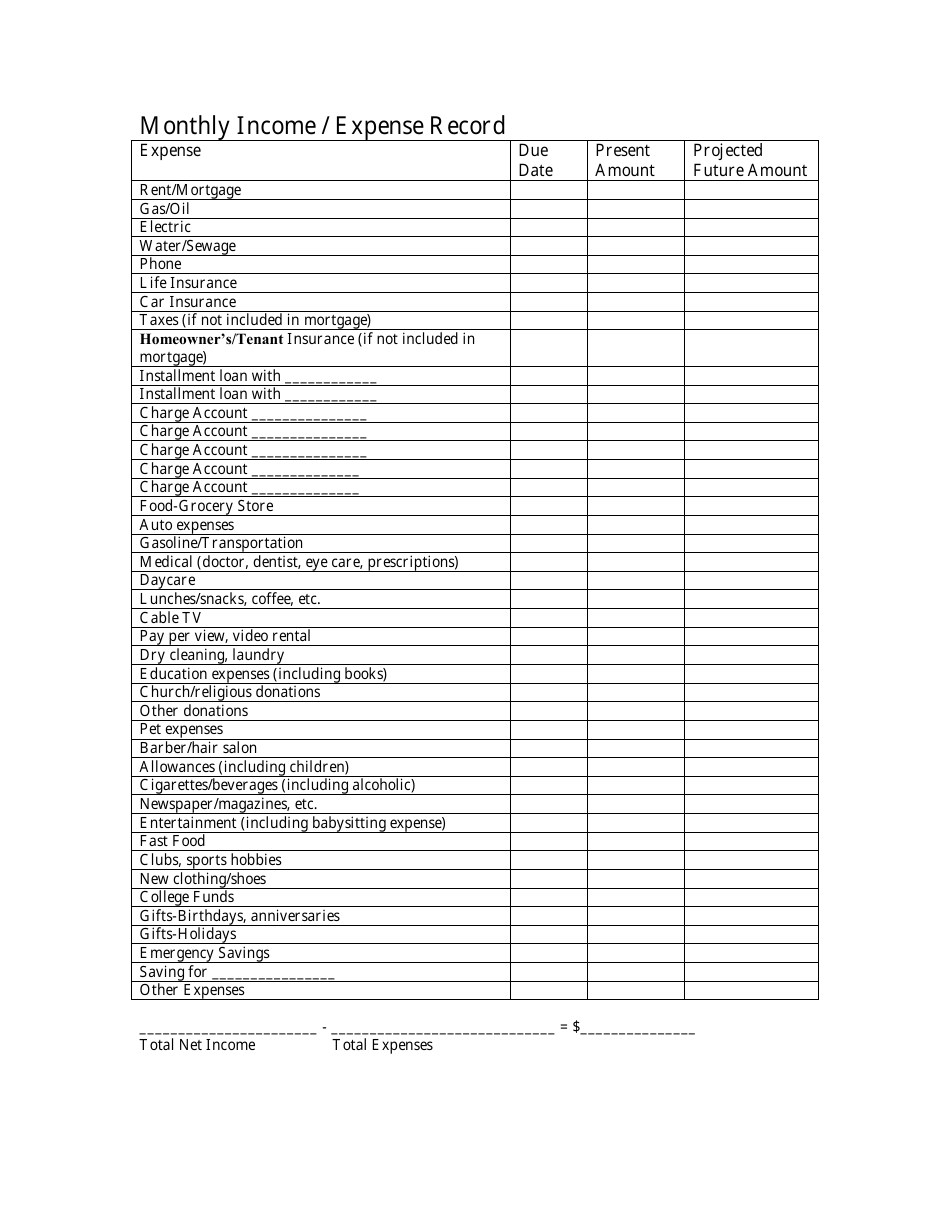

MONTHLY EXPENSES PERCENTAGE OF INCOME UPDATE

Please know that we always update the features in QuickBooks, and this preference might be available in the future.įor now, I suggest you visit the New Features section to stay up to date with all the changes in the product. To do this, divide the expense amount of a category by the total amount of monthly income, then multiply by 100 to get the percentage. We appreciate every input you have on this feature. For now, I suggest exporting the report to Excel and manually customize the output to acquire the data you need (see screenshot below). In comparison, 44 of middle income households and 14 of households. 61 of households in the lowest income group reported at least one indicator of financial stress in the past 12 months.

MONTHLY EXPENSES PERCENTAGE OF INCOME FULL

You can apply for and receive a full CPP retirement pension at age 65, a reduced amount as early as age 60, or an increased amount as late as age 70.I appreciate you for getting back to us here in the Community, me share some clarification about the Profit and Loss report in QuickBooks Desktop.Ĭurrently, an option or ability to add another column for the 2019 amounts (% of income) is unavailable. Household spending on education also saw the largest percentage increase in the 31 years 1984 to 2015-16, increasing by 13 times from 3 to 44 per week. (Employers and employees share the contribution equally.)Įarly/late retirement. If you’re self-employed, you’re responsible for your entire CPP/QPP contribution. If you stopped working or took a lower-paying job so you could stay home to raise your children, you may be able to use the child-rearing provision to increase your CPP benefits. Fooding 1000 SGD Restaurant 1000 SGD Water 50. net income would be around 3.6k.So as per survey monthly expense will be as below. the median monthly gross income in sg is 4.5k including compulsory govt CPF (equivalent of 401k) deductions of 20. The CPP drop-out provision partly protects you from employment interruptions or stretches of low income, by automatically dropping 17% (up to 8 years) of your lowest earnings from the calculation of your pension amount.Ĭhild-rearing provision. Mortgage Interest Rate in Percentages (), Yearly, for 20 Years Fixed-Rate : 2.12: 1. Expense The cost you spend every week/month/year for your needs. So any significant interruptions in your working life or reductions in your earnings – such as long periods of unemployment, caregiving, part-time work or attending school – can reduce your eventual CPP/QPP income. Income The amount of money you bring in weekly/monthly/annually. The longer you pay into CPP/QPP and the more you earn during that time, the higher your CPP/QPP payments will be when you retire.

0 kommentar(er)

0 kommentar(er)